The property tax season begins with the mailing of the Notice of Proposed Taxes (Truth-In-Millage or TRIM Notice) each August sent by the property appraiser’s office. Then, by November 1, the Tax Collector’s Office mails more than 600,000 property tax bills to property owners. These bills are sent to the address on file with the Property Appraiser’s Office. Make sure your address is up to date with the Palm Beach Country Property Appraiser’s Office. Property taxes are payable November 1 to March 31 each year.

Florida’s property taxes are administered by locally-elected officials and supported by the Florida Department of Revenue. In Palm Beach County, your Constitutional Tax Collector, Anne M. Gannon, collects more than $5 billion annually in property taxes and fees.

This revenue is then efficiently distributed to Palm Beach County’s taxing authorities to fund critical county and municipal public services, such as the school district, fire departments, libraries, parks and agriculture districts. The revenue also funds local children’s services and the healthcare district.

If you want to learn more about how your property tax dollars are distributed, you can review our annual report by clicking here (insert link to annual report).

Payment Options

We offer several convenient ways for you to pay your property tax. Click the button below to view your payment options.

Discounts for Early Payment

November

4% Discount

December

3% Discount

January

2% Discount

February

1% Discount

March

No Discount

April

Property Taxes Become Delinquent

Florida Statute extends discount/payment deadlines falling on a Saturday, Sunday, or holiday to the next business day.

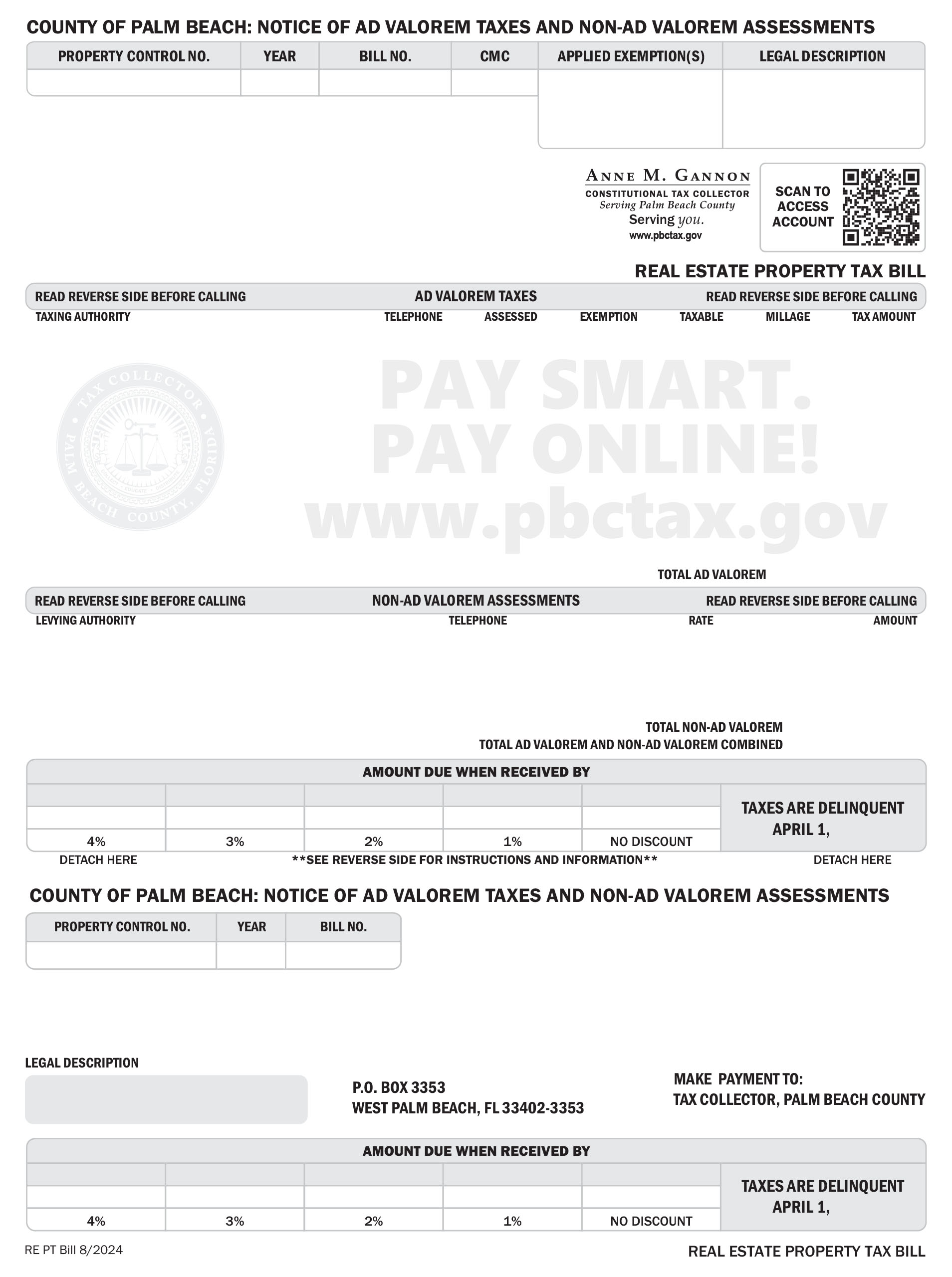

Property Tax Bill Explanation

Below is an interactive breakdown of a sample property tax bill, keep in mind the bill you receive in the mail may not look exactly like this. Click on the numbered icons for an explantion of each item on the property tax bill.

Property Control Number (PCN) or Tangible Personal Property Account Number (TPP)

A unique number is assigned to each property. Refer to this number when making inquiries.

Property Owner(s)

Verify ownership. If the property has been sold, forward the bill to the new owner(s) or notify us by completing an online form at: www.pbctax.com/propertysold

Mailing Address

If your mailing address has changed, contact the Property Appraiser at (561) 355-2866.

Exemptions

Approved exemptions will appear here. Report errors to the Property Appraiser at (561) 355-2866.

QR Code

Scan to be directed to the payment portal.

Assessed, Exemption & Taxable

Some exemptions are only applicable to certain taxing authorities.

Delinquent Tax Message

If this message is displayed on your bill, please contact the Tax Collector's office at (561) 355- 2264 for the delinquent amount due and payment options.

Delinquent Tax Message

If this message is displayed on your bill, please contact the Tax Collector's office at (561) 355- 2264 for the delinquent amount due and payment options.

Amount Due

Pay early and receive one of the following discounts: 4% in Nov., 3% in Dec., 2% in Jan., 1% in Feb. Gross amount due March 31, no discount applies.

Amount Due

Pay early and receive one of the following discounts: 4% in Nov., 3% in Dec., 2% in Jan., 1% in Feb. Gross amount due March 31, no discount applies.

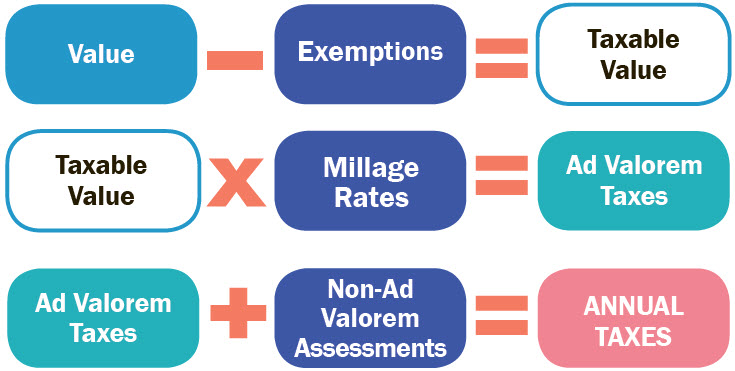

How your property taxes are Calculated

Your property tax is calculated by first determining the taxable value. The taxable value is your assessed value less any exemptions. The taxable value is then multiplied by your local millage rate to determine your ad valorem taxes. Ad valorem taxes are added to the non-ad valorem assessments. The total of these two taxes equals your annual property tax amount.

Your property’s assessed value is determined by the Palm Beach County Property Appraiser. The millage rate is set by each ad valorem taxing authority for properties within their boundaries.

Non-ad valorem assessments are determined by the levying authority using a unit measure to calculate the cost of services. For example, Solid Waste Authority fees are based on the type of property producing the waste.

Delinquent Property Taxes

Property tax is delinquent on April 1 and is subject to penalties and interest. Delinquent property tax cannot be paid online. Delinquent payments must be received on or before the last working day of the month to be considered paid in that month. Postmark date is not proof of payment once a tax is delinquent.

Payment Options

We offer several convenient ways for you to pay your delinquent property taxes. Click the button below to view your payment options.